What the 2025 Federal Election Means for Real Estate in Winnipeg and Across Canada

67% voter turnout was up from 63% the last election. Way to go, Canada!

How will Mark Carney’s Liberal minority government impact the Canadian and Winnipeg housing markets? We break down key real estate policies, interest rate predictions, and what buyers and sellers in Winnipeg can expect following the 2025 federal election.

The election results are in — and no matter where your vote landed, one thing’s clear:

what’s done is done.

Now, more than ever, Canada could use a little more kindness and a little less division.

So, let’s shift the focus to something that affects us all — our homes, our communities, and the housing market.

On April 28, 2025, Mark Carney’s Liberal Party secured victory, forming a minority government with 169 seats in the 343-seat Parliament. A former central banker, Carney ran on a platform focused on tackling Canada’s housing crisis, easing economic pressures, and strengthening ties with the United States.

Voter turnout was notably higher this year, reaching 67%, up from 63% in the last federal election — a sign that Canadians are feeling increasingly engaged. YAY! As for Manitoba, the results were fairly split: 7 seats went to the Conservatives, 6 to the Liberals, and 1 to the NDP.

But the big question remains: what will this mean for real estate — especially here in Winnipeg? Let’s break it down.

🏗️ 1. Ambitious Housing Supply Initiatives

The Liberals plan to double national housing completions to 500,000 units annually by 2030 through the establishment of Build Canada Homes (BCH), a crown corporation tasked with developing affordable housing on underutilized federal lands. While the goal is ambitious, experts note potential challenges, including labor shortages and limited modular construction capacity, which may hinder the rapid realization of these targets.

Implication: Buyers and sellers should be aware that while increased supply may alleviate housing pressures in the long term, immediate impacts on housing availability and prices may be limited for the foreseeable future.

💰 2. Financial Incentives for First-Time Buyers

To assist first-time homebuyers, the Liberal government proposes eliminating the Goods and Services Tax (GST) on new homes valued up to $1 million. This measure aims to reduce upfront costs and improve affordability for newcomers to the housing market.

Implication: Prospective first-time buyers may find enhanced opportunities to enter the market, potentially increasing demand in certain segments.

📉 3. Prospects for Lower Interest Rates

There is anticipation that the Bank of Canada may still implement interest rate cuts later this year. Lower borrowing costs could stimulate housing market activity by making mortgages more affordable. Winnipeg has always proven to be motivated heavily by interest rates and we could see things continuing on their competitive trajectory, as a result.

Implication: Buyers might benefit from reduced mortgage rates, while sellers could see increased interest in their properties due to improved affordability for purchasers. Bidding wars will likely continue throughout 2025.

🌍 4. Immigration Policies and Housing Demand

The Liberal government intends to maintain high immigration levels, targeting 500,000 newcomers annually, to support labor market needs and economic growth. While this approach addresses workforce shortages, it may also sustain or increase demand for housing, particularly in urban centers.

Implication: Continued population growth may exert upward pressure on housing demand, potentially affecting rental and homeownership markets.

🛃 5. Tariffs – are they Here to Stay?

We continue to get asked the same question: Are tariffs here to stay?

Truthfully, we still think no — and a recent poll from Fox News helps explain why public sentiment may eventually push for change:

72% believe tariffs will make products more expensive

44% say tariffs hurt U.S. jobs

55% feel tariffs harm the broader U.S. economy

That last stat is especially telling. Inflation, supply chain slowdowns, and uncertainty — are starting to wear on public confidence in the US. And historically, public opinion often shapes policy, especially when the economic pressure becomes too visible to ignore.

Implication: While we can’t predict the exact timing, we still believe this is a temporary chapter — not a permanent feature of trade policy.

🏘️ What does this all mean for Winnipeg?

In Winnipeg, the impact of federal policy will likely be nuanced.

While national initiatives aim to boost housing supply and affordability, local factors — like municipal regulations, land availability, and economic conditions — will continue to shape how those policies are felt on the ground.

Winnipeg has always existed in its own kind of insulated bubble. Here, we're often more influenced by interest rates and immigration — both of which seem poised to continue along their current path. And for now, that path points to more of the same: a strong seller’s market.

We’re optimistic about the promise of GST cuts on new home construction, but it remains to be seen how much of that benefit will actually reach buyers. In Manitoba, builders already include GST in MLS-listed prices. If the GST is removed, prices may drop slightly — but it also opens the door for builders to absorb the gain, rather than pass the savings on to the consumer.

We’re also watching closely to see if the government delivers on its promise to speed up housing development by cutting red tape. Here in Manitoba, one of the biggest bottlenecks we see is permitting delays. Yet, we have to be honest — Manitoba tends to lag behind in policy adoption. Case in point: digital signatures were only officially allowed in real estate here in 2020, and only because of pandemic-era health orders.

So, what’s our outlook?

More of the same — and that’s not necessarily a bad thing. Yes, there are unknowns and no crystal ball. But if history is any indicator, Winnipeg will remain one of the most stable and resilient real estate markets in Canada.

Mark our words.

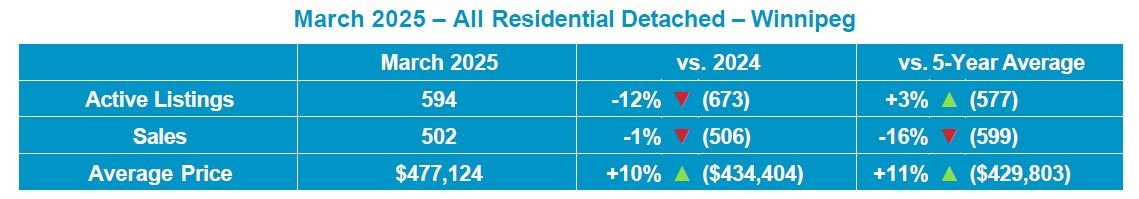

Some other quick hits for the Winnipeg Market for those that want the numbers (March was our most recent Board update):

Want to see the full report from the Board? Please reach out to us at Hello@QueenTeam.ca

This month’s lowest mortgage rates:

3-year fixed - 4.04%

5-year fixed - 4.04%

3-year variable – 4.15%

5-year variable - 4.20%

Got Feedback? I'd Love to Hear It!

Or if you want to receive our monthly newsletter updates (along with some awesome contests direct to your inbox), let us know! Email us at Hello@queenteam.ca—we’d love your input!

#AgentJen

Jennifer Queen

Tel: (204) 797-7945

Email: Jen@QueenTeam.ca