A Winnipeg Real Estate Market Update: July 2025

Know the difference between the National Headlines and the local market.

An excerpt from our most recent Newsletter. Want to sign up to receive these newsletters on a monthly basis? Sign up is in the Website footer below!

What’s Really Going On in Canada’s Economy—and How It Affects Winnipeg

Since May, national economic data has come in weaker than expected. Unemployment is rising, consumer confidence has slipped, and despite earlier interest rate cuts, housing in much of Canada is still struggling to gain traction. But here's the thing: real estate is local—and Winnipeg is telling a very different story.

While other markets are slowing, Winnipeg continues to defy the national trend. Home sales are holding strong, inventory remains tight, and condominiums are experiencing their best run in over a decade. Bidding wars? Still very much part of the landscape. It’s a reminder that blanket headlines rarely reflect what’s happening in our own backyard.

That said, national policy still matters. Decisions made by the Bank of Canada and the federal government shape mortgage rates, consumer sentiment, and even interprovincial migration. Construction delays, trade tensions, and global uncertainty have softened Canada’s overall growth outlook. But Canada still holds some key cards: low debt-to-GDP ratios, room for fiscal support, and strong trade access to the U.S. under CUSMA.

South of the border, the U.S. economy remains surprisingly resilient—thanks in large part to high government spending—though industrial sectors, closely linked to Canadian exports, are cooling. A U.S. recession isn’t expected this year, which is good news for Canadian businesses.

Closer to home, Bank of Canada Governor Tiff Macklem recently signaled that more rate cuts could come—but only if inflation eases and unemployment climbs. Right now, the market expects one more rate cut by the end of the year.

Across much of Canada, housing markets are trying to rebound, but rising inventory and a dip in population growth are keeping things sluggish. Meanwhile, a renewed Canada-U.S. trade agreement—reportedly in the works—could help restore confidence and spark more economic activity.

The silver lining? Ottawa is preparing new fiscal measures, including tax cuts and increased defence spending, set to roll out by late 2025. Forecasters are cautiously optimistic, nudging Canadian GDP growth slightly higher into 2026, with unemployment expected to peak around 7.1% this fall.

So, what does this all mean for us in Winnipeg?

While national headlines focus on slowdowns and uncertainty, our market remains active, competitive, and full of opportunity. Yes, we’re not immune to federal decisions—but our story continues to be one of resilience. And in real estate, local always matters most.

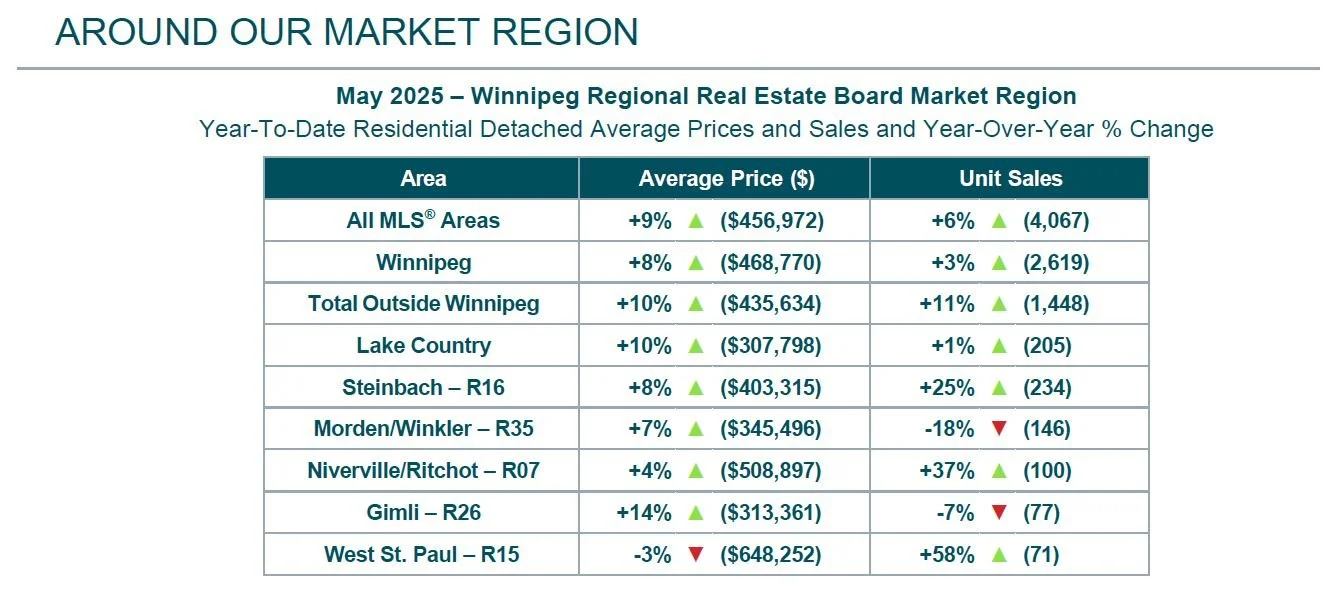

Here are the numbers from our most recent Board Report:

This month’s lowest mortgage rates:

3-year fixed - 4.14%

5-year fixed - 4.19%

3-year variable – 4.15%

5-year variable - 4.20%

Final Thoughts

I share this almost every time someone asks me when the best time to list a home is. Yes, there is some strategy on optimal timing of the market, but there are SOOOOO many other moving pieces that often go with selling a home. So when asked “What’s the best time to buy or sell?” my answer is always the same:

Whenever is right for you.

Reach out. Let’s discuss your goals, and what matters to you. THEN, and only then, we can formulate a plan that is right for you.

Got Feedback? We'd Love to Hear It!

Comments, concerns, or topics you'd like us to cover in our next newsletter? Let us know! Email us at Hello@queenteam.ca—we’d love your input!

Jennifer Queen

Phone: (204) 797-7945

Email: Jennifer@QueenTeam.ca