A Winnipeg Real Estate Market Update: June 2025

The market for Sellers has been HOT! But if you’re a buyer in this market, there may have been some heartache in 2025.

Welp, the numbers are out. And they’re nothing short of jaw-dropping.

If you're a homeowner—congratulations! Once again, you've benefited from the upward momentum of Winnipeg’s real estate market. Even condominium owners—who spent years watching values plateau after the 2015 condo legislation—are finally seeing their investments pay off. Yes, you too are riding that wave of appreciation. 🎉

But to those who delayed buying in hopes of lower interest rates... I truly feel for you. And while I never want to say “I told you so”… well, I definitely told you so.

Here’s the truth: Winnipeg remains one of the most stable housing markets in Canada. Some might argue it is the most stable—and while I haven’t crunched the full national data to confirm it, what we’ve observed speaks volumes.

In the past 50 years, Winnipeg has only seen three years where values dipped. And those dips?

✅ Were nothing when compared to the likes of other Canadian markets

✅ Showed full recovery (and then some) within the next 1.5 years.

What does that tell us? That buying and holding Winnipeg real estate has proven to be one of the most reliable long-term investments around.

But I’ll stop yapping and I’ll give you the numbers:

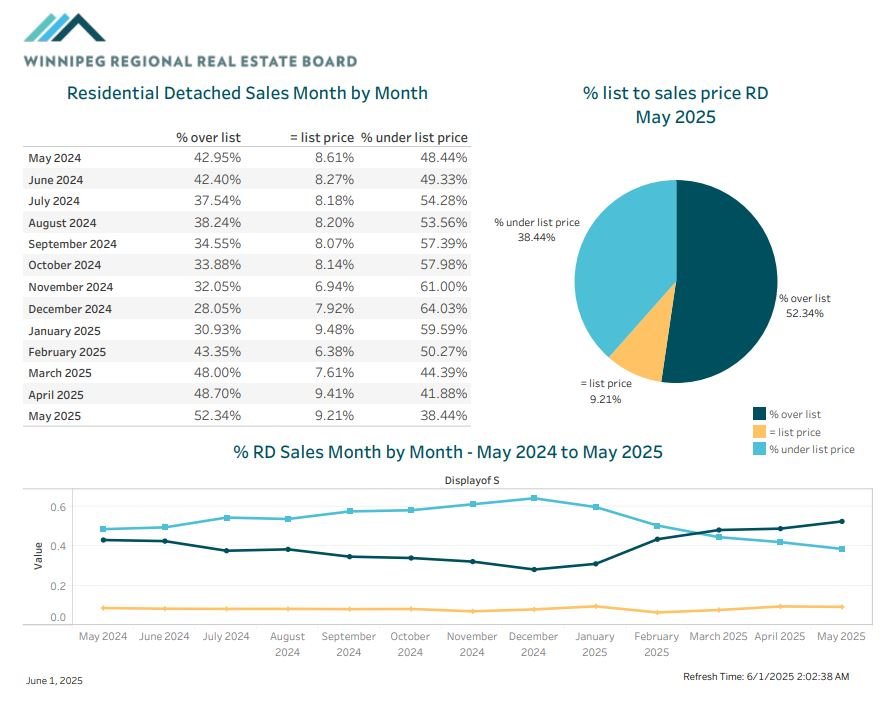

Bidding wars. They remained on the upper cusp of competitive due to limited inventory

Average MLS Sale price is now $412,236 (compared to $384,398 in 2024)

Average Residential Detached Sales Price is $459,320 (compared to $425,108 in 2024)

Average Residential Attached Sales Price is $381,871 (compared to $366,128 in 2024)

Average Condominium Sale Price is $297,864 compared (compared to $277,510 in 2024)

If you're curious where homes were really moving both in and around Winnipeg last month—here’s a quick snapshot (I apologize as these graphs are not as pretty as I would like them to be):

Here’s another great visual courtesy of our Board that really drives the point home.

What stands out most in these charts? Inventory is down. Way down.

But this isn’t just because fewer homes are being listed—it’s because they’re selling fast. Like, really fast. Many homes are flying off the market on their offer date, and a good number are seeing multiple offers, some even unconditional.

In short: it’s a competitive landscape. If you’re a buyer, preparation is everything. If you’re a seller, this is your moment to shine—especially if your home is properly marketed and priced right.

In May, Waverley West took the top spot for the most residential detached home sales in Winnipeg, with East Transcona coming in close behind. Outside the city limits, Steinbach led the way for sales activity, followed by Morden/Winkler—both showing strong momentum in their respective regions.

When it comes to price points, the sweet spot for buyers and sellers was clearly between $400,000–$499,999, which accounted for 25% of all residential detached MLS® sales. That was followed by the $300,000–$399,999 range, making up another 22% of the market.

What does this mean? Well, if you're in one of those neighbourhoods or price brackets, you're definitely not alone—these are the segments where buyers are stepping up, and inventory is moving quickly.

Let’s talk about the condo scene in Winnipeg last month—because yes, even condos are getting their moment.

Osborne Village led the pack for the most condominium sales in May, followed by Fort Richmond—two areas that continue to draw attention for their location, amenities, and overall vibe. Outside the city, Niverville/Ritchot saw the highest condo sales volume, with La Salle not far behind.

In terms of price points, the $200,000–$299,999 range was the hottest, making up 35% of all condo sales. Next in line was the $300,000–$399,999 bracket, with 22% of sales landing there.

And for the luxury lovers—yes, there was one standout condo sale that broke the million-dollar mark. It sold for just over $1.5 million in May. Proof that the right unit in the right location still commands serious value.

And now, for the real estate nerds (like me!)—let’s geek out for a second. 👓

Check out this graph, which shows when homes historically sell at—or above—list price. Not surprisingly, early May tends to be the sweet spot. It's typically when the most active buyers meet limited inventory, creating peak conditions for sellers.

But—did you miss the spring market? Don’t worry, you haven’t missed the boat.

We see bidding wars all year long—yes, even in December, despite what this graph might suggest. With the right strategy, timing, and marketing, you can still maximize your sale price, no matter the season.

Because selling your home isn’t just about when—it’s about how.

Here’s one more graph I had to share—courtesy of the Winnipeg Regional Real Estate Board. 📊

What I love about this one is how clearly it shows where our current market stands in comparison to the wild ride of 2021. And here’s the kicker: we’re tracking just behind those record-breaking numbers.

Let’s not forget—2021 was a market on fire, fuelled by historically low interest rates and lifestyle changes (remote work, anyone?). Rates we may never see again in our lifetimes.

Then came 2023. Rates began climbing with no clear end in sight, and naturally, many buyers hit pause—uncertain about what rising interest meant for their budgets.

But now? Things have normalized. Interest rates aren’t as scary as they seemed. And despite the shift, the market is proving resilient—demand is strong, and well-priced, well-marketed homes are still moving fast (many often with multiple offers).

This isn’t just a rebound—it’s a rebalancing. And it’s showing us just how strong the foundation of Winnipeg’s real estate market really is.

Final Thought

I share the stats for those who love to "game" the system—those curious minds who want to know the optimal moment to buy or sell.

Historically, if you're selling and want to maximize your sale price, April through mid-May has been the sweet spot. That’s when buyer competition is fierce and bidding wars are most common.

On the flip side, if you’re a buyer looking for a potential deal, November and December tend to offer quieter conditions—and less competition.

But here’s the real truth: the price swings between these periods usually aren’t dramatic. We’re not talking tens of thousands of dollars in difference. Often, it comes down to timing, personal readiness, and life circumstances more than the market itself.

So when people ask me, “What’s the best time to buy or sell?” my answer is always the same:

Whenever is right for you.

We can help guide you on the rest—pricing, preparation, marketing, negotiation. But the timing? That’s personal. You let us know when you're ready, and we’ll make sure you're set up for success.

Jennifer Queen

Phone: (204) 797-7945

Email: Jennifer@QueenTeam.ca