Winnipeg Real Estate Market Update for Summer 2025: Is This Surge in Sales and Prices Sustainable?

Is this current trend sustainable?

Winnipeg Real Estate Is Sizzling—But Is It Sustainable?

As the June 2025 Winnipeg Real Estate Board Report rolled in, there was one statistic that made me pause mid-scroll:

👉 There were 48% more $1 million+ homes sold in June 2025 than in June 2024.

This, at a time when some other Canadian markets are showing signs of softening. Toronto has been tapering off. Vancouver is seeing more caution creep in and long sales timelines. But here in Winnipeg? We're not just holding steady—we're breaking records.

It’s a fascinating—and important—moment to unpack. Because what we’re seeing isn’t just a spike. It’s a pattern. One that raises critical questions for buyers, sellers, and investors alike.

Let’s dig into what this report tells us—and what it doesn’t.

Luxury Home Sales Are Up—But So Is the Heat Across the Market

When you hear “48% more million-dollar home sales,” it’s easy to assume that the high end of the market is leading the charge. And while that’s partly true (especially with one property selling over $2.3M last month), it’s not the full story.

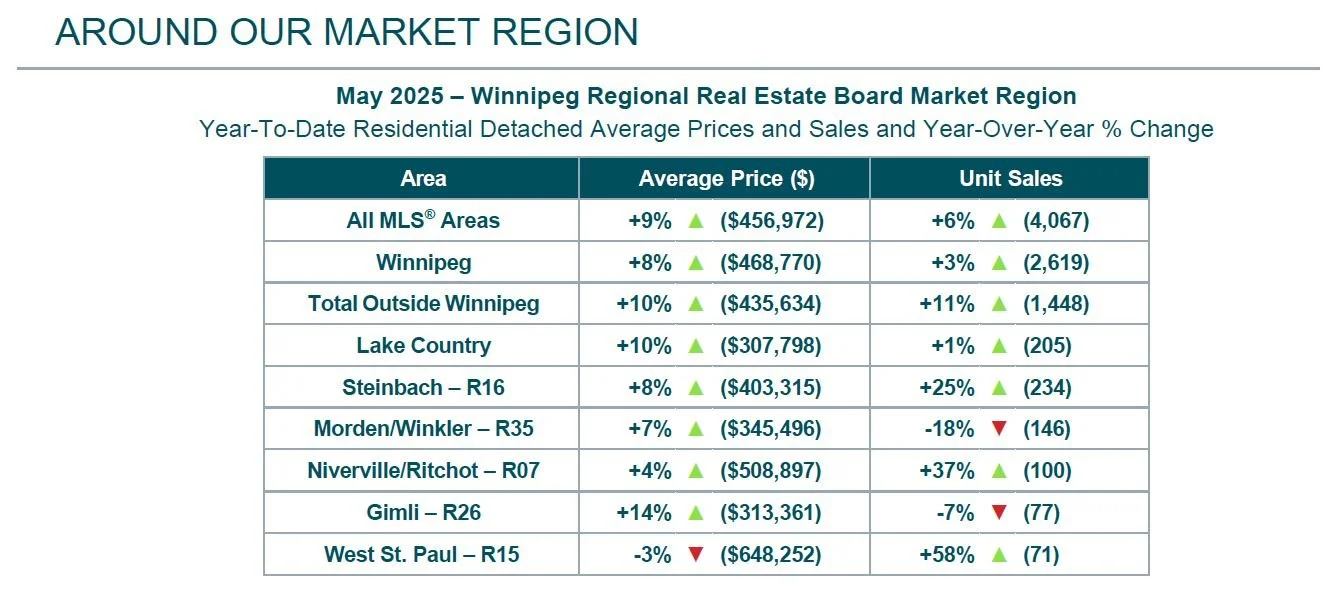

Across all detached homes, the average sale price in June hit $473,131—a jump of 8% year-over-year. And condos weren’t far behind at $291,647, up 7% from the same time last year. These aren’t isolated increases. This is sustained momentum.

And it’s not just about price. It’s also how homes are selling.

For the fourth month in a row, most detached homes sold above list price. That’s not an agent trick or fluke—it’s the reality of today’s supply-and-demand imbalance. Yes, some still underprice to try and get more aggressive bidding wars. In a market like this, buyers are quick to act and correct any underpricing. However, we have had a few circumstances on the team where we already priced on the high side of where the comparables support, and the property still sells in a bidding war.

It is a great time to be a Seller. Definitely challenging though if you are a Buyer!

We're Not New to a Seller’s Market—But It’s Still Evolving

Many people ask: Is this really a seller’s market?

My answer is a resounding yes—and not just this month. Winnipeg has been in a sustained seller’s market for much of the last two+ decades.

But what’s interesting now is how educated and strategic buyers have become. They know the game. They understand that if they want the house, they’ve got to come strong—and often let go of the “wish list” to secure their needs.

As a team, we’re helping buyers prepare by:

Reviewing recent sales, not just list prices. Because in today’s climate, list price is a starting point, not a ceiling.

Doing pre-offer inspections, where we arrange home inspections before we even write an offer. Yes, it’s a risk. But it’s also a winning strategy—one that helped several of our clients succeed this past month alone.

Seeking out opportunities for less competitive options (either off-market, or what might have been missed on market).

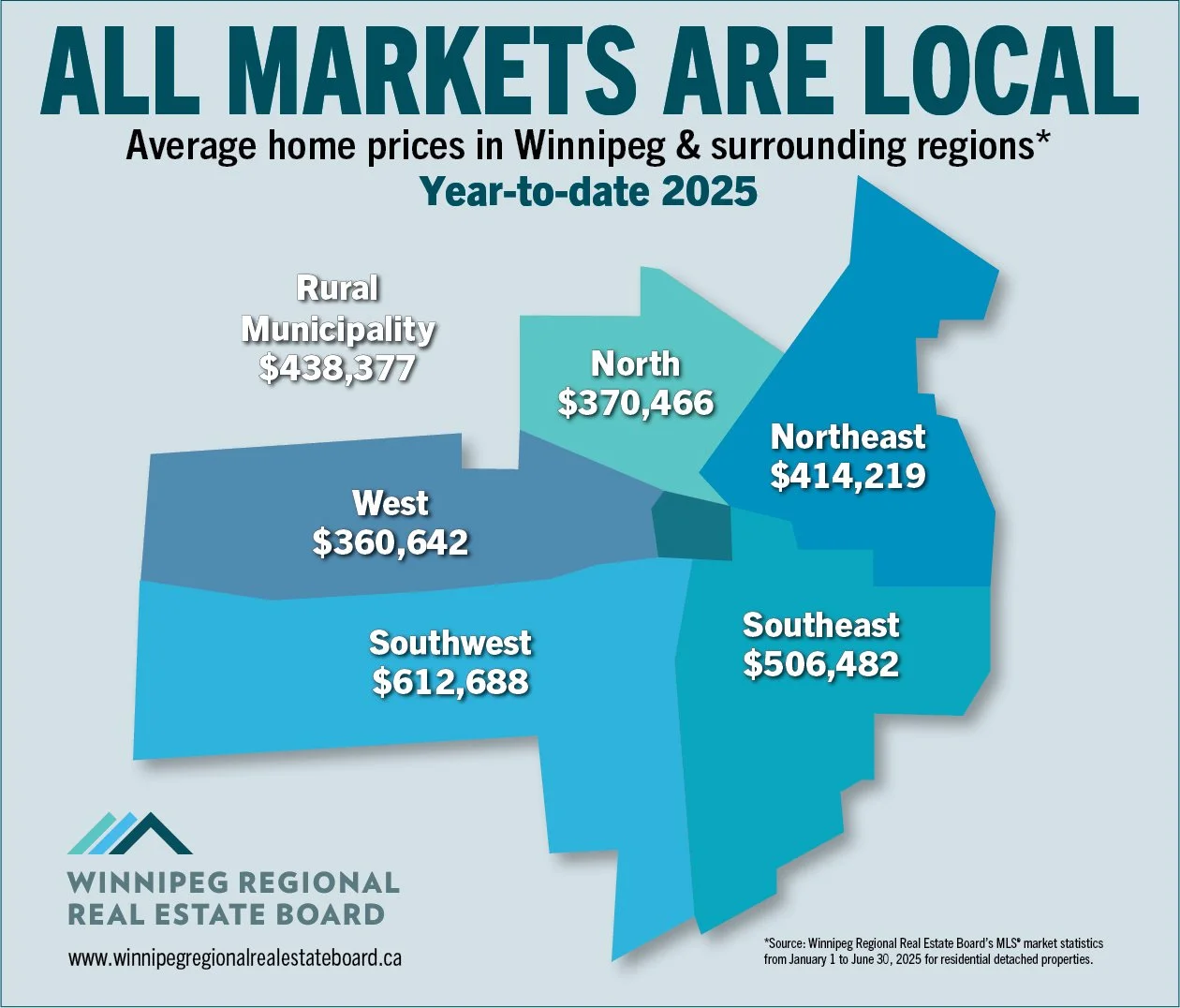

La Salle, Steinbach, and the Rise of the Outlying Communities

Another stat that jumped off the page?

🏡 La Salle saw a 45% increase in average detached home price year-over-year.

That’s not a typo. La Salle—once a slower-moving pocket—has caught fire.

What we’re seeing is a direct ripple effect of rising Winnipeg prices. As affordability tightens in the city, families and first-time buyers are heading outward to communities like:

Steinbach, which saw a 13% increase in sales and a 7% price bump.

Niverville/Ritchot, with a 17% spike in sales.

Gimli, where buyers are increasingly drawn to cottage-style living within commuting distance.

These aren’t just “bedroom communities” anymore. They’re self-sustaining towns with schools, services, and a strong sense of community—plus a bit more yard and square footage for your dollar.

But Is This Growth Sustainable?

It’s the question on every economist’s mind—and every cautious buyer’s, too.

Here's my take:

📉 I don’t see a correction coming. Winnipeg’s market is grounded. We're still well below the national average home price—hovering at nearly half the national figure, which keeps investment strong and migration positive.

📈 But no, I don’t expect these 8–10% year-over-year gains to continue indefinitely. Historically, Winnipeg real estate appreciates closer to 2–3% annually, which is a healthier long-term trend aligned with inflation.

So, while I believe the market will remain strong, I’d expect more modest gains ahead rather than another surge.

Who’s Feeling the Pressure Right Now?

There’s no doubt—first-time home buyers are facing headwinds.

Yes, there are still homes available under $300,000, but they’re competitive. These buyers are often weighing trade-offs like:

Neighbourhood vs. condition

Renovation potential vs. move-in ready

Commute times vs. lot size

What’s also interesting is how condominiums are finally seeing their own rebound. After years of slower momentum, the condo market is tightening, with increased sales and higher price points. It’s a classic trickle-over effect—similar to what we’re seeing in the suburbs.

Source: Winnipeg Regional Real Estate Board.

Our Best Advice?

You haven’t missed your window. Seriously.

There’s no “perfect time” to buy or sell.

There’s only your right time.

If your life is telling you it’s time to move—listen to that. Because 10 years from now, you’re not going to regret buying in Winnipeg. You’re going to be grateful you acted. Take it from me.

My only real estate regrets at this point are properties I didn’t buy… not the ones I did.

The only people who tend to lose out in this market?

👉 The ones who keep “waiting it out.”

Final Thoughts

June’s market report tells a compelling story of a city (and surrounding communities) that’s growing, thriving, and evolving. That has been much of the story of the resilient Winnipeg Real Estate Market since I’ve been a Realtor and then some – I went back to 1974 to review just how resilient our market is here. And trust me, I don’t think there is a better investment than real estate in Winnipeg!

If you’re thinking about buying or selling, you don’t have to navigate it alone. Whether you’re looking in the heart of River Heights or considering a shift to St. Norbert or Charleswood—or even outside the perimeter—we’re here to guide you with data, strategy, and heart.

Reach out anytime. The best time to plan your next move? Today.

This month’s lowest mortgage rates:

3-year fixed - 4.14%

5-year fixed - 4.19%

3-year variable – 4.15%

5-year variable - 4.20%

Final Thoughts

I share this almost every time someone asks me when the best time to list a home is. Yes, there is some strategy on optimal timing of the market, but there are SOOOOO many other moving pieces that often go with selling a home. So when asked “What’s the best time to buy or sell?” my answer is always the same:

Whenever is right for you.

Reach out. Let’s discuss your goals, and what matters to you. THEN, and only then, we can formulate a plan that is right for you.

Got Feedback? We'd Love to Hear It!

Comments, concerns, or topics you'd like us to cover in our next newsletter? Let us know! Email us at Hello@queenteam.ca—we’d love your input!

Jennifer Queen

Phone: (204) 797-7945

Email: Jennifer@QueenTeam.ca